==============사용할 로직==========

(역배열 제외 )

15분봉상. => 2일 내로.

볼벤 20 , 2 상한선 근접 or 돌파

엔벨로프 37,4.7 상한선 근접 or 돌파

엔벨로프 37, 3.8 상한선 돌파

하단선 20,2 볼벤 하단선 에서 2% 이하.

파라볼릭 SAR 0.017, 0.017, 0.17 이 두번 연속 상승 (중간 하락 1번)

==================================

사전 다운해서 구성할 패키지들입니다

from binance.client import Client # python-binance

from binance.spot import Spot #!pip install binance-connector

import pickle

import ccxt

import requests

import time

import requests

from datetime import datetime

import pandas as pd

from tqdm import tqdm

import math

import numpy as np

import matplotlib.pyplot as plt

def bin_sym_names():#바이낸스 심볼명들 도출

result = requests.get('https://api.binance.com/api/v3/ticker/price')

js = result.json()

symbols = [x['symbol'] for x in js]

symbols_usdt = [x for x in symbols if 'USDT' in x] # 끝이 USDT로 끝나는 심볼들, ['BTCUSDT', 'ETHUSDT', ...]

return symbols_usdt

def bin_get_data(start_date, end_date, symbol , interval): # 시작일 , 종료일 , 심볼명 , 분/시간/일/주/월 데이터 선택

URL = 'https://api.binance.com/api/v3/klines'

COLUMNS = ['Open_time', 'Open', 'High', 'Low', 'Close', 'Volume', 'Close_time', 'quote_av', 'trades',

'tb_base_av', 'tb_quote_av', 'ignore']

data = []

start = int(time.mktime(datetime.strptime(start_date + ' 00:00', '%Y-%m-%d %H:%M').timetuple())) * 1000

end = int(time.mktime(datetime.strptime(end_date +' 23:59', '%Y-%m-%d %H:%M').timetuple())) * 1000

params = {

'symbol': symbol,

'interval': interval,

'limit': 1000,

'startTime': start,

'endTime': end

}

while start < end:

# print(datetime.fromtimestamp(start // 1000))

params['startTime'] = start

result = requests.get(URL, params = params)

js = result.json()

if not js:

break

data.extend(js) # result에 저장

start = js[-1][0] + 60000 # 다음 step으로

# 전처리

if not data: # 해당 기간에 데이터가 없는 경우

print('해당 기간에 일치하는 데이터가 없습니다.')

return -1

df = pd.DataFrame(data)

df.columns = COLUMNS

df['Open_time'] = df.apply(lambda x:datetime.fromtimestamp(x['Open_time'] // 1000), axis=1)

df = df.drop(columns = ['Close_time', 'ignore'])

df['Symbol'] = symbol

df.loc[:, 'Open':'tb_quote_av'] = df.loc[:, 'Open':'tb_quote_av'].astype(float) # string to float

df['trades'] = df['trades'].astype(int)

# df['Open_time'] = pd.to_datetime(df['Open_time'], format='%Y-%m-%d %H:%M:%S', errors='raise')

# df = df.set_index('Open_time',drop=True)

return df먼저 이런 식으로 모든 심볼들 데이터를 확인 할 수 있도로 데이터를 로드하고

분/시간/일/주 등으로 나누어서 쉽게 가져올 수 있도록 바이낸스 API를 데이터를 좀 더 가져오기 쉽게 구현하였다.

이것 조금 있따가 컬럼을 보기 좀 쉬게 하기 위해서 만들어 두었다.

def about_time_start_inday_(day_or_time=4): # 뺼 날자

now_time = datetime.now()

diff_days = dt.timedelta(hours=day_or_time) # dt.timedelta(days=0, seconds=0, microseconds=0, milliseconds=0, minutes=0, hours=0, weeks=0)

# diff_days = dt.timedelta(days=day_or_time) # @ 일단 day로 되어 있음.

start_date = (now_time - diff_days).strftime("%Y-%m-%d") # 오늘 부터 몇 일 전

now_day_time = now_time.strftime("%Y-%m-%d") # 현재 날짜

return now_day_time, start_date # start_date = now_time - diff_days시작 날짜를 몇일 전 데이터 부터 불러올지 정하게 해두었따(시간으로도 바꿀수 있다)

# 단순 이동 평균(Simple Moving Average, SMA)

def SMA(data, period=30, column='Close'):

return data[column].rolling(window=period).mean()

def Bollinger_Band(df, period=30, column='Close', multiplier=2):

df['Bollinger_Band_' + str(period) + '_mid_' + str(multiplier)] = df['Close'].rolling(period).mean() # 20일 이동평균

df['stddev'] = df['Close'].rolling(period).std() # 20일 이동표준편차

df['Bollinger_Band_' + str(period) + 'upper_' + str(multiplier)] = df['Bollinger_Band_' + str(period) + '_mid_' + str(multiplier)] + multiplier * df['stddev'] # 상단밴드

df['Bollinger_Band_' + str(period) + 'lower_' + str(multiplier)] = df['Bollinger_Band_' + str(period) + '_mid_' + str(multiplier)] - multiplier * df['stddev'] # 하단밴드

del df['stddev']

return df

def one_look_equilibrium_chart(df, one_look_equilibrium_chart_Conversion_Line_period, one_look_equilibrium_chart_base_line_period, one_look_equilibrium_chart_lagging, one_look_equilibrium_chart_displacement): # 일목균형표

high_prices = df['High']

close_prices = df['Close']

low_prices = df['Low']

dates = df.index

nine_period_high = df['High'].rolling(window=one_look_equilibrium_chart_Conversion_Line_period).max()

nine_period_low = df['Low'].rolling(window=one_look_equilibrium_chart_Conversion_Line_period).min()

df['전환선'] = (nine_period_high + nine_period_low) / 2 # 전환선

period26_high = high_prices.rolling(window=one_look_equilibrium_chart_base_line_period).max()

period26_low = low_prices.rolling(window=one_look_equilibrium_chart_base_line_period).min()

df['기준선'] = (period26_high + period26_low) / 2 # 기준선

df['BB_선행_span_a'] = ((df['전환선'] + df['기준선']) / 2).shift(one_look_equilibrium_chart_base_line_period) # 선행스팬 1

period52_high = high_prices.rolling(window=one_look_equilibrium_chart_lagging).max()

period52_low = low_prices.rolling(window=one_look_equilibrium_chart_lagging).min()

df['BB_선행_span_b'] = ((period52_high + period52_low) / 2).shift(one_look_equilibrium_chart_base_line_period) # 선행스팬 2

df['BB_후행_span'] = close_prices.shift(-one_look_equilibrium_chart_displacement) # 후행스팬

# print('전환선: ',df['전환선'].iloc[-1])

# print('기준선: ',df['기준선'].iloc[-1])

# print('후행스팬: ',df['후행_span'].iloc[-one_look_equilibrium_chart_displacement-1])

# print('선행스팬1: ',df['선행_span_a'].iloc[-1])

# print('선행스팬2: ',df['선행_span_b'].iloc[-1])

# del df["기준선"]

# del df["전환선"]

return df

def envelop(df, column='Close', window=40, gap=10):

ma20 = df[column].rolling(window).mean()

idx = ma20.index

en_high, en_low = [], []

for i in range(len(ma20)):

en_high.append(ma20[i] + ((ma20[i] * gap) / 100))

en_low.append(ma20[i] - ((ma20[i] * gap) / 100))

df["envelop_high" + '_' + str(window) + '_' + str(gap)] = pd.Series(en_high, index=idx)

df["envelop_low" + '_' + str(window) + '_' + str(gap)] = pd.Series(en_low, index=idx)

return df

def close_or_open_or_mix(a): # @시시 종 은 아직.

if a == "시가":

return "Open"

elif a == "종가":

return "Close"

class PSAR:

def __init__(self, init_af=0.02, max_af=0.2, af_step=0.02):

self.max_af = max_af

self.init_af = init_af

self.af = init_af

self.af_step = af_step

self.extreme_point = None

self.high_price_trend = []

self.low_price_trend = []

self.high_price_window = deque(maxlen=2)

self.low_price_window = deque(maxlen=2)

# Lists to track results

self.psar_list = []

self.af_list = []

self.ep_list = []

self.high_list = []

self.low_list = []

self.trend_list = []

self._num_days = 0

def calcPSAR(self, high, low):

if self._num_days >= 3:

psar = self._calcPSAR()

else:

psar = self._initPSARVals(high, low)

psar = self._updateCurrentVals(psar, high, low)

self._num_days += 1

return psar

def _initPSARVals(self, high, low):

if len(self.low_price_window) <= 1:

self.trend = None

self.extreme_point = high

return None

if self.high_price_window[0] < self.high_price_window[1]:

self.trend = 1

psar = min(self.low_price_window)

self.extreme_point = max(self.high_price_window)

else:

self.trend = 0

psar = max(self.high_price_window)

self.extreme_point = min(self.low_price_window)

return psar

def _calcPSAR(self):

prev_psar = self.psar_list[-1]

if self.trend == 1: # Up

psar = prev_psar + self.af * (self.extreme_point - prev_psar)

psar = min(psar, min(self.low_price_window))

else:

psar = prev_psar - self.af * (prev_psar - self.extreme_point)

psar = max(psar, max(self.high_price_window))

return psar

def _updateCurrentVals(self, psar, high, low):

if self.trend == 1:

self.high_price_trend.append(high)

elif self.trend == 0:

self.low_price_trend.append(low)

psar = self._trendReversal(psar, high, low)

self.psar_list.append(psar)

self.af_list.append(self.af)

self.ep_list.append(self.extreme_point)

self.high_list.append(high)

self.low_list.append(low)

self.high_price_window.append(high)

self.low_price_window.append(low)

self.trend_list.append(self.trend)

return psar

def _trendReversal(self, psar, high, low):

# Checks for reversals

reversal = False

if self.trend == 1 and psar > low:

self.trend = 0

psar = max(self.high_price_trend)

self.extreme_point = low

reversal = True

elif self.trend == 0 and psar < high:

self.trend = 1

psar = min(self.low_price_trend)

self.extreme_point = high

reversal = True

if reversal:

self.af = self.init_af

self.high_price_trend.clear()

self.low_price_trend.clear()

else:

if high > self.extreme_point and self.trend == 1:

self.af = min(self.af + self.af_step, self.max_af)

self.extreme_point = high

elif low < self.extreme_point and self.trend == 0:

self.af = min(self.af + self.af_step, self.max_af)

self.extreme_point = low

return psar

def PSAR_SAR(data, start, increment, Maximun):

indic = PSAR()

data['PSAR'] = data.apply(

lambda x: indic.calcPSAR(x['High'], x['Low']), axis=1)

# Add supporting data

data['EP'] = indic.ep_list

data['Trend'] = indic.trend_list

data['AF'] = indic.af_list

data["PSAR_SAR" + '_' + str(increment) + '_' + str(Maximun)] = data['PSAR']

return data각각 단순이동평균, 볼린저 밴드,일목균형표, 엔벨로프, 파라볼릭 PSAR

을 날짜에 맞춰서 쉽게 만들었다.

start = 0.017

increment = 0.017

Maximun = 0.17

PSAR_SAR(data[bin_sym_name[sym_i]] ,start ,increment,Maximun)

df = data[bin_sym_name[sym_i]].copy()

import matplotlib.pyplot as plt

import mpl_finance

import matplotlib.ticker as ticker

fig = plt.figure(figsize=(24, 8))

colors = plt.rcParams['axes.prop_cycle'].by_key()['color'] # 색 지정 편하게

ax = fig.add_subplot(111)

index = df["Open_time"].astype("str") # 캐늗ㄹ스틱 축이 str로 드가

ax.plot(index, df['Bollinger_Band_20upper_2'], label='Bollinger_Band_20upper_2', linewidth=0.7)

ax.plot(index, df['Bollinger_Band_20upper_2'], label='Bollinger_Band_20lower_2', linewidth=0.7) # 하단선에서 2% 이하.

ax.plot(index, df['envelop_high_37_4.7'], label='envelop_high_37_4.7', linewidth=0.7)

ax.plot(index, df['envelop_low_37_4.7'], label='envelop_low_37_4.7', linewidth=0.7)

# psar

psar_bull = df.loc[df['Trend']==1]['PSAR']

psar_bear = df.loc[df['Trend']==0]['PSAR']

ax.scatter(psar_bull.index, psar_bull, s = 1,color=colors[1], label='PSAR Up Trend',linewidths = 0.5)

ax.scatter(psar_bear.index, psar_bear, s = 1,color=colors[3], label='PSAR Down Trend',linewidths = 0.5)

ax.xaxis.set_major_locator(ticker.MaxNLocator(5))

mpl_finance.candlestick2_ohlc(ax, df['Open'], df['High'], df['Low'], df['Close'], width=0.5, colorup='r', colordown='b')내가 사용해 보고픈 로직을 모두 넣으면 이런식으로 구성된다.

조금 대충 만든 이미지 이다. 목적은 알람을 보내는 봇을 만드는 것이라서 이렇게 그렸었다.

여기까지는 대충 이런식으로 나타내는것이고 exe로 만들기 전 파일은 이렇다.{전체 코드}

import time

import pandas as pd

from IPython.display import clear_output

def bin_sym_names(): # 바이낸스 심볼명들 도출

result = requests.get('https://api.binance.com/api/v3/ticker/price')

js = result.json()

symbols = [x['symbol'] for x in js]

symbols_usdt = [x for x in symbols if 'USDT' in x] # 끝이 USDT로 끝나는 심볼들, ['BTCUSDT', 'ETHUSDT', ...]

return symbols_usdt

def bin_get_data(start_date, end_date, symbol, interval): # 시작일 , 종료일 , 심볼명 , 분/시간/일/주/월 데이터 선택

URL = 'https://api.binance.com/api/v3/klines'

COLUMNS = ['Open_time', 'Open', 'High', 'Low', 'Close', 'Volume', 'Close_time', 'quote_av', 'trades',

'tb_base_av', 'tb_quote_av', 'ignore']

data = []

start = int(time.mktime(datetime.strptime(start_date + ' 00:00', '%Y-%m-%d %H:%M').timetuple())) * 1000

end = int(time.mktime(datetime.strptime(end_date + ' 23:59', '%Y-%m-%d %H:%M').timetuple())) * 1000

params = {

'symbol': symbol,

'interval': interval,

'limit': 1000,

'startTime': start,

'endTime': end

}

while start < end:

# print(datetime.fromtimestamp(start // 1000))

params['startTime'] = start

result = requests.get(URL, params=params)

js = result.json()

if not js:

break

data.extend(js) # result에 저장

start = js[-1][0] + 60000 # 다음 step으로

# 전처리

if not data: # 해당 기간에 데이터가 없는 경우

print('해당 기간에 일치하는 데이터가 없습니다.')

return -1

df = pd.DataFrame(data)

df.columns = COLUMNS

df['Open_time'] = df.apply(lambda x: datetime.fromtimestamp(x['Open_time'] // 1000), axis=1)

df = df.drop(columns=['Close_time', 'ignore'])

df['Symbol'] = symbol

df.loc[:, 'Open':'tb_quote_av'] = df.loc[:, 'Open':'tb_quote_av'].astype(float) # string to float

df['trades'] = df['trades'].astype(int)

# df['Open_time'] = pd.to_datetime(df['Open_time'], format='%Y-%m-%d %H:%M:%S', errors='raise')

# df = df.set_index('Open_time',drop=True)

return df

import telegram #pip install python-telegram-bot

import requests

def Telegramchat(text): # @ 병석이형

telegram_token = '5683819516:AAHtOJwnhw3oEbtgc7fxdpHtmg6r9_pTCdc'

telegram_chat_id = '5503730871'

bot = telegram.Bot(token = telegram_token)

url = 'https://api.telegram.org/bot'+telegram_token+'/sendMessage?chat_id='+telegram_chat_id+'&text='+text

return requests.get(url)

def removeAllOccur(l, i):

try:

while True: l.remove(i)

except ValueError:

pass

from datetime import datetime

import datetime as dt

# def about_time_start(day_or_time=10): # 뺼 날자

# now_time = datetime.now()

# diff_days = dt.timedelta(days=day_or_time) # @ 일단 day로 되어 있음.

#

# start_date = (now_time - diff_days).strftime("%Y-%m-%d") # 오늘 부터 몇 일 전

# now_day_time = now_time.strftime("%Y-%m-%d") # 현재 날짜

#

# return now_day_time, start_date # start_date = now_time - diff_days

def about_time_start_inday_(day_or_time=4): # 뺼 날자

now_time = datetime.now()

diff_days = dt.timedelta(hours=day_or_time) # dt.timedelta(days=0, seconds=0, microseconds=0, milliseconds=0, minutes=0, hours=0, weeks=0)

# diff_days = dt.timedelta(days=day_or_time) # @ 일단 day로 되어 있음.

start_date = (now_time - diff_days).strftime("%Y-%m-%d") # 오늘 부터 몇 일 전

now_day_time = now_time.strftime("%Y-%m-%d") # 현재 날짜

return now_day_time, start_date # start_date = now_time - diff_days

# 단순 이동 평균(Simple Moving Average, SMA)

def SMA(data, period=30, column='Close'):

return data[column].rolling(window=period).mean()

def Bollinger_Band(df, period=30, column='Close', multiplier=2):

df['Bollinger_Band_' + str(period) + '_mid_' + str(multiplier)] = df['Close'].rolling(period).mean() # 20일 이동평균

df['stddev'] = df['Close'].rolling(period).std() # 20일 이동표준편차

df['Bollinger_Band_' + str(period) + 'upper_' + str(multiplier)] = df['Bollinger_Band_' + str(period) + '_mid_' + str(multiplier)] + multiplier * df['stddev'] # 상단밴드

df['Bollinger_Band_' + str(period) + 'lower_' + str(multiplier)] = df['Bollinger_Band_' + str(period) + '_mid_' + str(multiplier)] - multiplier * df['stddev'] # 하단밴드

del df['stddev']

return df

def one_look_equilibrium_chart(df, one_look_equilibrium_chart_Conversion_Line_period, one_look_equilibrium_chart_base_line_period, one_look_equilibrium_chart_lagging, one_look_equilibrium_chart_displacement): # 일목균형표

high_prices = df['High']

close_prices = df['Close']

low_prices = df['Low']

dates = df.index

nine_period_high = df['High'].rolling(window=one_look_equilibrium_chart_Conversion_Line_period).max()

nine_period_low = df['Low'].rolling(window=one_look_equilibrium_chart_Conversion_Line_period).min()

df['전환선'] = (nine_period_high + nine_period_low) / 2 # 전환선

period26_high = high_prices.rolling(window=one_look_equilibrium_chart_base_line_period).max()

period26_low = low_prices.rolling(window=one_look_equilibrium_chart_base_line_period).min()

df['기준선'] = (period26_high + period26_low) / 2 # 기준선

df['BB_선행_span_a'] = ((df['전환선'] + df['기준선']) / 2).shift(one_look_equilibrium_chart_base_line_period) # 선행스팬 1

period52_high = high_prices.rolling(window=one_look_equilibrium_chart_lagging).max()

period52_low = low_prices.rolling(window=one_look_equilibrium_chart_lagging).min()

df['BB_선행_span_b'] = ((period52_high + period52_low) / 2).shift(one_look_equilibrium_chart_base_line_period) # 선행스팬 2

df['BB_후행_span'] = close_prices.shift(-one_look_equilibrium_chart_displacement) # 후행스팬

# print('전환선: ',df['전환선'].iloc[-1])

# print('기준선: ',df['기준선'].iloc[-1])

# print('후행스팬: ',df['후행_span'].iloc[-one_look_equilibrium_chart_displacement-1])

# print('선행스팬1: ',df['선행_span_a'].iloc[-1])

# print('선행스팬2: ',df['선행_span_b'].iloc[-1])

# del df["기준선"]

# del df["전환선"]

return df

def envelop(df, column='Close', window=40, gap=10):

ma20 = df[column].rolling(window).mean()

idx = ma20.index

en_high, en_low = [], []

for i in range(len(ma20)):

en_high.append(ma20[i] + ((ma20[i] * gap) / 100))

en_low.append(ma20[i] - ((ma20[i] * gap) / 100))

df["envelop_high" + '_' + str(window) + '_' + str(gap)] = pd.Series(en_high, index=idx)

df["envelop_low" + '_' + str(window) + '_' + str(gap)] = pd.Series(en_low, index=idx)

return df

def close_or_open_or_mix(a): # @시시 종 은 아직.

if a == "시가":

return "Open"

elif a == "종가":

return "Close"

# class PSAR:

# def __init__(self, init_af=0.02, max_af=0.2, af_step=0.02):

# self.max_af = max_af

# self.init_af = init_af

# self.af = init_af

# self.af_step = af_step

# self.extreme_point = None

# self.high_price_trend = []

# self.low_price_trend = []

# self.high_price_window = deque(maxlen=2)

# self.low_price_window = deque(maxlen=2)

#

# # Lists to track results

# self.psar_list = []

# self.af_list = []

# self.ep_list = []

# self.high_list = []

# self.low_list = []

# self.trend_list = []

# self._num_days = 0

#

# def calcPSAR(self, high, low):

# if self._num_days >= 3:

# psar = self._calcPSAR()

# else:

# psar = self._initPSARVals(high, low)

#

# psar = self._updateCurrentVals(psar, high, low)

# self._num_days += 1

#

# return psar

#

# def _initPSARVals(self, high, low):

# if len(self.low_price_window) <= 1:

# self.trend = None

# self.extreme_point = high

# return None

#

# if self.high_price_window[0] < self.high_price_window[1]:

# self.trend = 1

# psar = min(self.low_price_window)

# self.extreme_point = max(self.high_price_window)

# else:

# self.trend = 0

# psar = max(self.high_price_window)

# self.extreme_point = min(self.low_price_window)

#

# return psar

#

# def _calcPSAR(self):

# prev_psar = self.psar_list[-1]

# if self.trend == 1: # Up

# psar = prev_psar + self.af * (self.extreme_point - prev_psar)

# psar = min(psar, min(self.low_price_window))

# else:

# psar = prev_psar - self.af * (prev_psar - self.extreme_point)

# psar = max(psar, max(self.high_price_window))

#

# return psar

#

# def _updateCurrentVals(self, psar, high, low):

#

# if self.trend == 1:

# self.high_price_trend.append(high)

# elif self.trend == 0:

# self.low_price_trend.append(low)

#

# psar = self._trendReversal(psar, high, low)

#

# self.psar_list.append(psar)

# self.af_list.append(self.af)

# self.ep_list.append(self.extreme_point)

# self.high_list.append(high)

# self.low_list.append(low)

# self.high_price_window.append(high)

# self.low_price_window.append(low)

# self.trend_list.append(self.trend)

#

# return psar

#

# def _trendReversal(self, psar, high, low):

# # Checks for reversals

# reversal = False

# if self.trend == 1 and psar > low:

# self.trend = 0

# psar = max(self.high_price_trend)

# self.extreme_point = low

# reversal = True

# elif self.trend == 0 and psar < high:

# self.trend = 1

# psar = min(self.low_price_trend)

# self.extreme_point = high

# reversal = True

#

# if reversal:

# self.af = self.init_af

# self.high_price_trend.clear()

# self.low_price_trend.clear()

# else:

#

# if high > self.extreme_point and self.trend == 1:

# self.af = min(self.af + self.af_step, self.max_af)

# self.extreme_point = high

# elif low < self.extreme_point and self.trend == 0:

# self.af = min(self.af + self.af_step, self.max_af)

# self.extreme_point = low

#

# return psar

#

#

def PSAR_SAR(data, start, increment, Maximun):

indic = PSAR()

data['PSAR'] = data.apply(

lambda x: indic.calcPSAR(x['High'], x['Low']), axis=1)

# Add supporting data

data['EP'] = indic.ep_list

data['Trend'] = indic.trend_list

data['AF'] = indic.af_list

data["PSAR_SAR" + '_' + str(increment) + '_' + str(Maximun)] = data['PSAR']

return data

import warnings

warnings.filterwarnings(action='ignore')

## 일봉기준.

# 바이낸스 상장 심볼명 (현물) 데이터 가져옮

bin_sym_name = bin_sym_names() # bin_sym_name = symbols_usdt

day_or_time = 4

# 시작~끝일 데이터 가져옮

end_date, start_date = about_time_start_inday_(day_or_time = day_or_time + 1)

start_date = str(start_date)#'2017-01-01' # 시작일 (2017 년도 부터 가능)

end_date = str(end_date)#'2022-12-31' # 종료일

interval = "30m" # '1d','4h',"1m"

try:

api_limit = ((160000 / 24) / 60) / 60 # 초당 보낼 수 있는 요청 주문수. # 하루 160000

data = {}

while True:

time_sleep_secend = len(bin_sym_name) / api_limit

# for sym_i in range(len(bin_sym_name)):

for sym_i in bin_sym_name:

symbol = sym_i # 숫자만 바꾸면 다른 코인 데이터 가져롬

print(symbol)

# close_or_open = close_or_open_or_mix(str(input()))#시가 / 종가 기준..

close_or_open = close_or_open_or_mix("종가") # 시가 / 종가 기준..

data[symbol] = bin_get_data(start_date, end_date, symbol, interval) # @@ 모든데이터 data에 저장하기 위해 딕셔너리 형태로 받음. 추후에 변경 가능

try:

data[symbol] = bin_get_data(start_date, end_date, symbol, interval) # @@ 모든데이터 data에 저장하기 위해 딕셔너리 형태로 받음. 추후에 변경 가능

### 표 적용.

# WINDOW = [6, 20 ,37 , 74 ,149] # 이평선 여러개 도출

# for WINDOW_i in WINDOW:

# data[symbol]["단순이동평균_"+str(close_or_open)+str(WINDOW_i)] = SMA(data[symbol], period=WINDOW_i, column=close_or_open)

# 일목균형표

# one_look_equilibrium_chart_Conversion_Line_period = 12 # == window

# one_look_equilibrium_chart_base_line_period = 37

# one_look_equilibrium_chart_lagging = 74 # 선행 스팬 기간

# one_look_equilibrium_chart_displacement = 37 #후행스팬기간?

# one_look_equilibrium_chart(data[symbol],one_look_equilibrium_chart_Conversion_Line_period,one_look_equilibrium_chart_base_line_period,one_look_equilibrium_chart_lagging,one_look_equilibrium_chart_displacement)

BB_period = 20 # 볼벤

BB_multiplier = 2 # 볼벤 승수 (std * BB_multiplier)

Bollinger_Band(data[symbol], period=BB_period, column=close_or_open, multiplier=BB_multiplier)

window = 37

gap = 4.7

envelop(data[symbol], column=close_or_open, window=window, gap=gap)

window = 37

gap = 3.8

envelop(data[symbol], column=close_or_open, window=window, gap=gap)

# 파리볼릭 SAR

start = 0.017

increment = 0.017

Maximun = 0.17

# PSAR_SAR(data[symbol], start, increment, Maximun)

# 주가데이터 .

df = data[symbol].copy()

BB_nearing_per_upper = 0.02 # 주가 근접할 %

BB_nearing_per_lower = 0 # 주가 근접할 %

envelop_nearing_per_upper = 0.02 # 주가 근접할 %

diff_day = day_or_time # 몇일 기준으로 볼것인지

df_1 = df.loc[df['Open_time'].between((df.iloc[-1:, ]["Open_time"] - dt.timedelta(days=diff_day)).values[0], df.iloc[-1:, ]["Open_time"].values[0])]

# 일봉상 기준..

logic_1 = df_1["Bollinger_Band_20upper_2"] * (1 - BB_nearing_per_upper) > df_1["Close"] # 볼벤 20 , 2 상한선 근접 or 돌파

# print(sum(logic_1))

logic_1_1 = sum(logic_1) > 1

logic_2 = df_1["envelop_high_37_4.7"] * (1 - envelop_nearing_per_upper) > df_1["Close"] # 엔벨로프 37,4.7 상한선 근접 or 돌파

# print(sum(logic_2))

logic_2_1 = sum(logic_2) > 1

logic_3 = df_1["envelop_high_37_3.8"] * (1 - envelop_nearing_per_upper) > df_1["Close"] # 엔벨로프 37, 3.8 상한선 돌파

# print(sum(logic_3))

logic_3_1 = sum(logic_3) > 1

# logic_4 = df_1["Bollinger_Band_20lower_2"] * (1-BB_nearing_per_lower) >df_1["Low"] #엔벨로프 37, 3.8 상한선 돌파

logic_4 = df_1["Bollinger_Band_20lower_2"] * (1 - BB_nearing_per_lower) > df_1["Close"] # 엔벨로프 37, 3.8 상한선 돌파

# print(sum(logic_4))

logic_4_1 = sum(logic_4) > 1

# logic_5 = ( # 파라볼릭.

# df_1["Trend"].diff().value_counts()[1] > 2 and # 상승추세 2번

# df_1["Trend"].diff().value_counts()[-1] > 1 and # 하락추세 1번

# 1 == df_1.iloc[-1:].Trend.values[0] # 지금은 상승중

# ) # 하락추세 1번 # 지금은 상승중

# if sum([logic_1_1, logic_2_1, logic_3_1, logic_4_1, logic_5]) == 4:

if sum([logic_1_1, logic_2_1, logic_3_1, logic_4_1]) == 4:

send_text = str("심볼명 :" + symbol + " "

"logic_1 = " + str(sum(logic_1)) + " "

"logic_2 = " + str(sum(logic_2)) + " "

"logic_3 = " + str(sum(logic_3)) + " "

"logic_4 = " + str(sum(logic_4)) + " "

# "logic_5 = " + str((logic_5))

)

response = Telegramchat(send_text)

print(send_text)

except:

removeAllOccur(bin_sym_name, symbol)

pass

# time.sleep(5)

time.sleep(time_sleep_secend)

clear_output(wait=True)

except:

send_text = "봇 종료"

response = Telegramchat(send_text)

그러면 실행파일인 cmd창 하나 뜨고 cmd창을 종료하면 봇이 종료 된다.

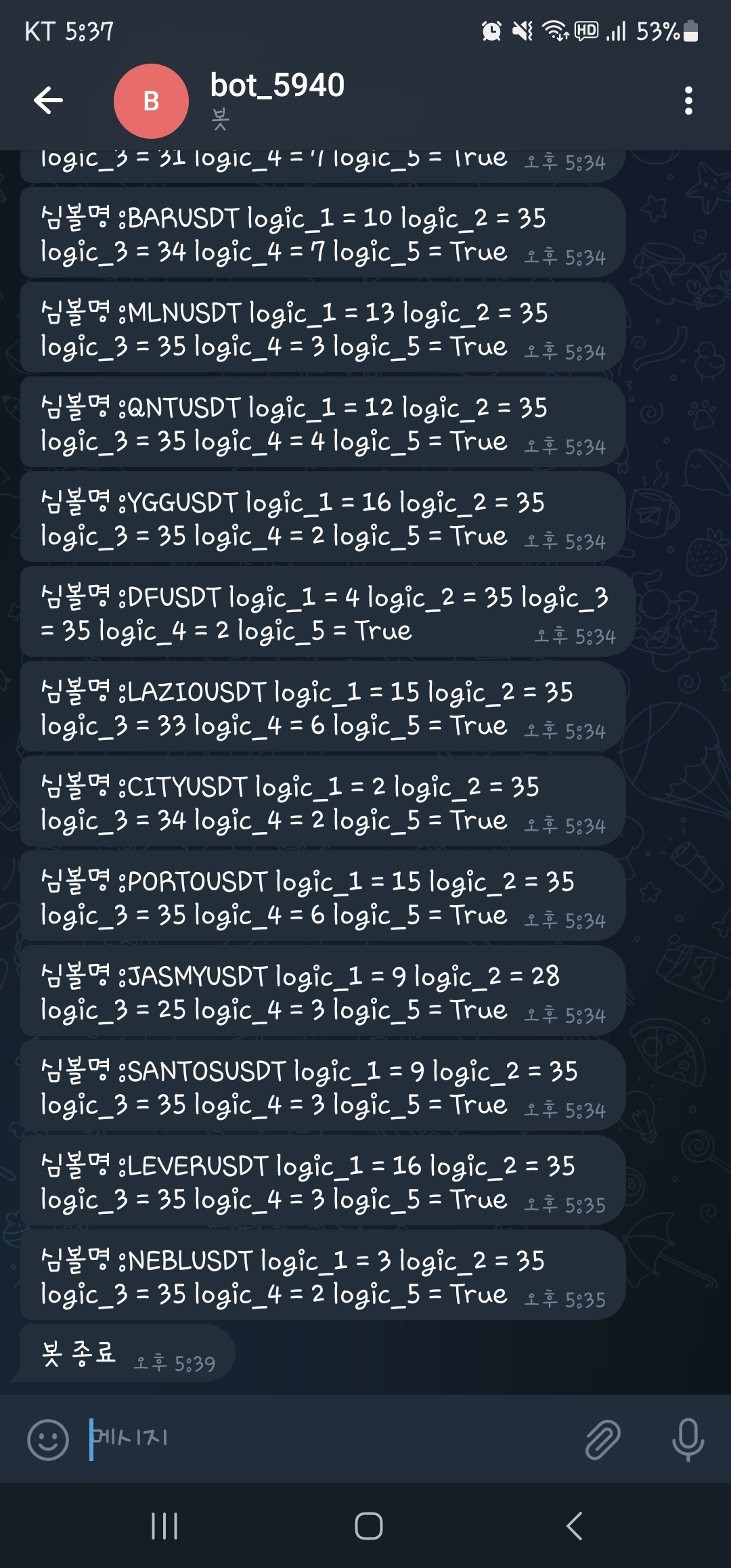

내 텔레그램 봇 예시이다.

etc)

삼각가중이동평균, 최소제곱평균, 지수이동평균, 가중이동평균 함수도 만들었었는데 여기에 공유해두겠다

# 지수 이동 평균(Exponential Moving Average, EMA)

def EMA(data, period=3, column='Close'):

return data[column].ewm(span=period, adjust=False).mean()

def WMA(data, period=3, column='Close'): #가중이동평균

val = []

for i in range(WINDOW):

val.append(None)

for i in range(len(data)-period):

df = data[[column]].loc[i+1:i+period].reset_index(drop = True)

sum_count_1 = 0

sum_count_2 = 0

for j in range(period):

sum_count_1 = sum_count_1 + (j+1) * float(df.iloc[j].values)

sum_count_2 = sum_count_2 + (j+1)

val.append(sum_count_1/sum_count_2)

return val

def LSMA(data, period=3, column='Close'): # 최소제솝평균..

val = []

for i in range(WINDOW):

val.append(None)

for i in range(len(data)-period):

df = data[[column]].loc[i+1:i+period].reset_index(drop = True)

X = [k+1 for k in range(period)]

Y = [float(df.iloc[k]) for k in range(period)]

LRS = (len(X) * sum([X[i]*Y[i] for i in range(len(X))])- sum(X)*sum(Y)) /(len(X) * sum([X[i]*X[i] for i in range(len(X))]) - sum(X) * sum(X))

LRT = (sum(Y) - LRS * sum(X)) / (len(X))

LRI = LRT + LRS * len(X)

val.append(LRI)

return val

# data, period, column = data, WINDOW, '종가'

def triangular_weighted_moving_average(data, period=20, column='Close'):

val = []

for i in range(WINDOW):

val.append(None)

for i in range(len(data)-period):

df = data[[column]].loc[i+1:i+period].reset_index(drop = True)

A = int(np.ceil((period+0.1)/2)) # N기간을 2로나눔 (소수점 반올림)

B = float(df.iloc[0:A].mean()) #A기간동안의 이동평균값

for_Trima = list(df[column].values)

for_Trima.insert(0, B)

Trima = np.mean(for_Trima)#B값의 A기간 이동평균값

val.append(np.mean(Trima))

return val

깃허브 링크

'IT - 코딩 > 트레이딩 관련' 카테고리의 다른 글

| 무위험 차익거래 자동매매 프로그램 2.주요 이슈와 해결 내용. (0) | 2023.02.26 |

|---|---|

| 무위험 차익거래 자동매매 프로그램 1.API허용 및 입출금 주소등록 (5) | 2023.02.26 |

| 트위터 api를 통한 긍부정 판단(NLP)모델을 추가한 추적 손절매 응용 방식 (0) | 2023.02.23 |

| yes trader 데이터 전처리(with python)+인베스트 , 데이터 가이드 포함 (0) | 2022.07.22 |

| 데이터 가이드 데이터 전처리(with python)+인베스트 , yes trader포함 (1) | 2022.07.22 |